The 2024 Douglas Elliman | Knight Frank Wealth Report Is Here – Tides Are Changing In Miami

The Douglas Elliman | Knight Frank Wealth Report is here again for the 18th year, and there is some very special news about the Miami luxury and ultra-luxury market. In the 2024 report, we see that Miami has hit an unmistakable inflection point. Change is upon us and there is no going back. So where are we headed?

Out With The Old – Miami Has Changed

It used to be that mentions of Miami Beach conjured up thoughts of Cocaine Cowboys and wild Spring Breakers. This is no longer the case.

The Cocaine Cowboys days are now just a Netflix novelty and w hile the Spring Breakers are still interested in Miami, the sentiment is not shared. This shift has been in the works for years, with locals calling for a stop to the unhinged lawlessness. After a particularly wild season in 2023, Miami Beach introduced strict new guidelines for peak weekends in order to quell the interest.

There was even a cute PSA that was released, letting Spring Breakers know that we are breaking up with them.

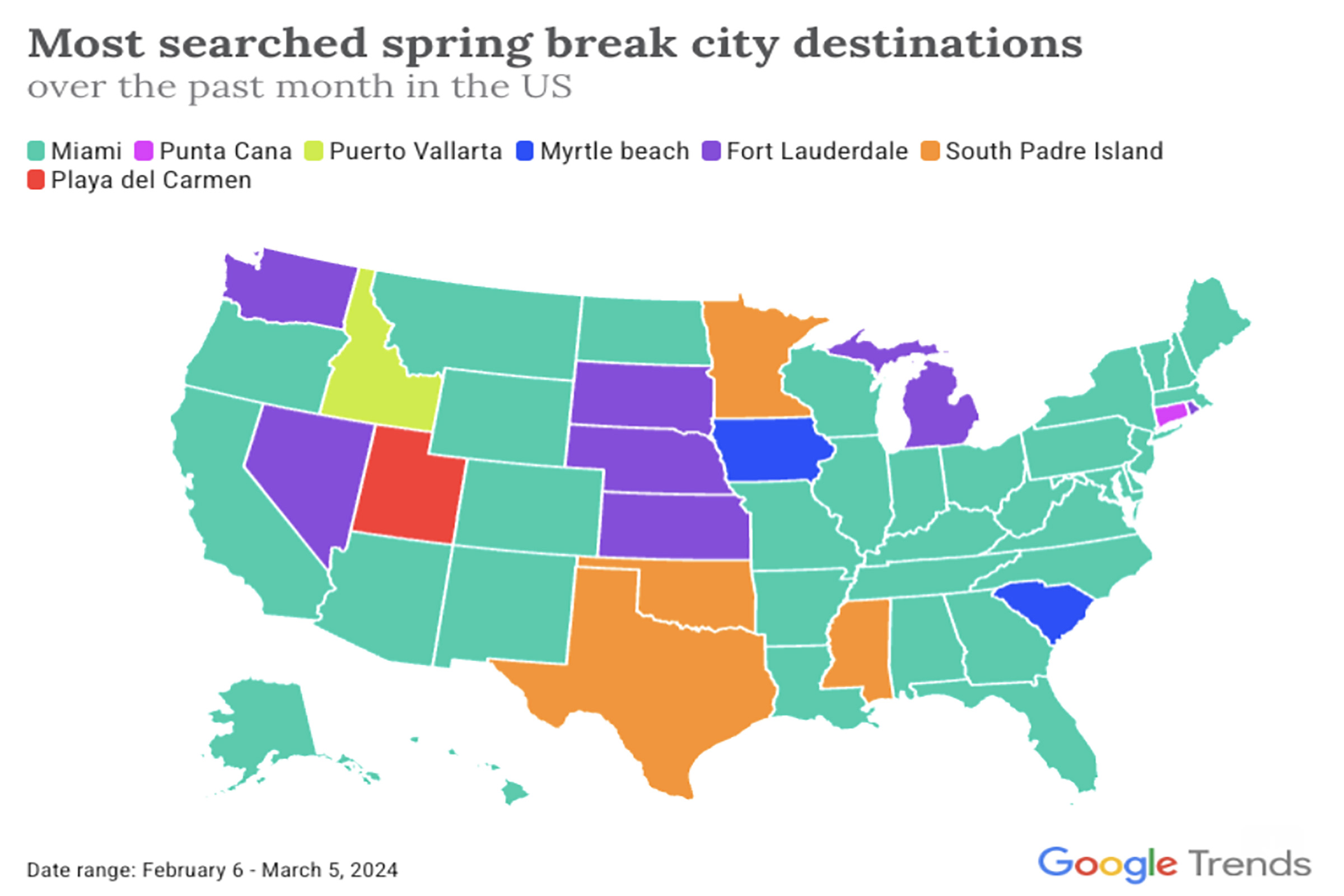

The PSA and hefty guidelines seem to have been effective. According to Google Trends, Miami was the #1 searched city for Spring Break destinations in most of the United States, yet the season has been extremely peaceful this year. You can see on this live walking tour of the beach today, the sand is clean and everybody is relaxing.

Now that we have made our point about having outgrown our past, we can embrace the future of Miami and Miami Beach.

Luxury Competition

The Miami Beach luxury real estate market has been on an upward trajectory for a few year (since COVID to be exact), but we are now entering into uncharted territory. Even billionaires now struggle to get a slice of the South Florida waterfront, according to the Wealth Report.

Developers have been working tirelessly to keep up with the demand for sophisticated boutique developments in prime locations. While Miami Beach and Miami have long been havens for vacation properties, one of the main differences we are seeing is that buyers are searching for full-time residences.

The world has learned that Jeff Bezos saved $600 million for relocating his home base to Indian Creek Island in Miami Beach. This is not an uncommon phenomenan. Kenneth Griffin relocated both his personal and professional headquarters to Mainland Miami, bringing thousands of hungry financiers with him. The Wealth Report indicates that driver’s license changes are up 78% in the first 9 months of 2023, an indicator of the volume of new Miamians we are gaining.

Growing Pains

The unprecedented growth of the Magic City has not come without pain. The single family market has cooled as buyers began to pull back from the demands of sellers, although growth was still pronounced.

Our local infrastructure is also hustling to keep up with the demands. We brushed on this yesterday for 305 Day, speaking about the increased competition for a limited number of private school spots. In the meantime, UHNW parents are bringing their New York A-game in order to win a coveted spot for their students.

Another growing pain is one that we cannot get around. Miami has only so much land, and what we do have is largely built-out. The only solution is vertical construction. This lack of supply will protect current pricing and force it to continue upward in the coming years.

Future-Focused Strategy

Because we are still early in the migration cycle, it is incredibly possible to reserve a property in the preconstruction phase and sell it once the development comes to fruition. Multiple investors have undertaken this strategy, whether they could not decide which project is a better fit or if they were strictly looking at the transaction for the upside potential in a trophy asset, and it pays.

Griffin’s Citadel has not even completed the build-out of their temporary office space in the Brickell Financial District and we are still waiting for the first renderings of their permanent headquarters on Brickell Bay Drive. We like to use Citadel as an example as they are the largest and most public example of the financial migration, but there are dozens of similar companies that are coming along with them.

Considering we have already experienced the growth that is well-documented in the Douglas Elliman | Knight Frank Wealth Report, this inflection point is a permanent trajectory toward a higher level of luxury and wealth in Miami.

If you, or someone you know, are interested in purchasing luxury real estate in Miami and/or Miami Beach, please contact Broker Michael Light, Founder/Owner of the Miami Luxury Homes Group at Douglas Elliman Real Estate, Senior Director of Luxury Sales at Douglas Elliman and a member of its elite Sports & Entertainment Division. Michael has over 15 years of experience working with influential buyers from all over the world and is an expert on educating buyers on market statistics and trends. You may reach Michael directly on his cell phone at (786) 566-1700 or via email at moc.semohyruxulimaim@leahcim.

#miamibeachcondofinancing, #miamibeachmortgagebroker, #miamibeachmortgagecompany, #miamibeachmortgagerates, #miamimortgage, #miamimortgagebroker, #miamimortgagerates